Washington, DC - A new must-read piece in The Nation by Michelle Chen highlights the details and implications of the recent Economic Policy Institute (EPI) and Roosevelt Institute report that found that the merger of T-Mobile and Sprint would reduce retail wireless workers’ wages across the country.

Ahead of next week’s Capitol Hill hearings about the merger, the new article and the recent EPI/Roosevelt report offer more reminders why the T-Mobile/Sprint merger fails the public interest test and would harm workers.

See below for key excerpts of Michelle Chen’s story in The Nation, titled “How Corporate Monopolies Are Dragging Down Your Paycheck” (available in full online here).

“Typically, the policy debate around antitrust regulation is whether consumers will pay unfair prices for a dominant software brand or local cable provider. But a study by the Economic Policy Institute (EPI) and the Roosevelt Institute shows that the pending merger of T-Mobile and Sprint presents other threats to the public welfare. An analysis of the labor impacts of the merger reveals that the impending consolidation of the two wireless giants would not only fuse already massive telecommunications markets but also tighten brick-and-mortar retail-employment sectors—all at the expense of workers’ paychecks. At the hot-pink T-Mobile storefronts that now pepper shopping districts around the country, retail workers (those who market phones and other electronics and handle repairs) could see their earnings fall by thousands of dollars per year.

... The damage to earnings resulting from this monopolization would be felt across the area’s labor market—meaning, the merger is likely to drag down wages not only for T-Mobile and Sprint employees, but for workers across the board. In 50 major labor markets nationwide, the study concludes that by a higher estimate, “weekly earnings will decline by $63 on average,” while the smallest projection would average $10 a week. Over the course of an average year, total income could fall by as much as $3,276.

...The erosion of workers earnings reflects an often overlooked ripple effect of monopoly power, the evil twin in the labor market known as monopsony: When corporations merge, they strengthen their grip on the local labor market. Monopolization through mega-mergers purports to yield corporate “efficiency” that benefits consumers and productivity, yet limits options in the labor market and undermines workers’ ability to negotiate labor conditions.

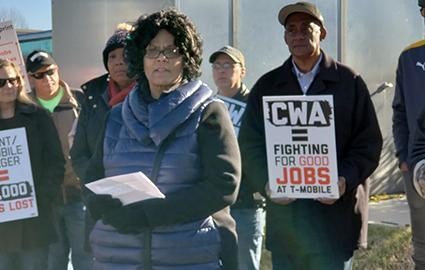

...The proposed T-Mobile/Sprint merger caps a decades-long pattern of eroding labor power, which leaves workers lacking union representation and often precariously employed in heavily segmented, non-union supply chains, where unions represent just nine percent of the sector nationwide. The T-Mobile union CWA—which commissioned the study—has criticized the proposed merger as a threat to consumers as well as jobs and working conditions.

...The standard framework of antitrust law tends to ignore labor factors when weighing the costs and benefits of a merger. The myopic focus on the consumer impacts—how the market price would shift for your next data plan—overlooks the potential impact on the local economy, and by extension how workers would experience the expansion of the monopolistic corporate footprint.”

Press Contact:

Beth Allen

[email protected]

202-434-1168